Of all the documents, analyses, and financial reports that real estate investors have at their disposal, the rent roll is one of the most valuable.

Buyers use a rent roll to understand current and future cash flows, sellers monitor the rent roll to learn if the rental property is performing as expected, while lenders review the rent roll to help decide whether or not to make a loan.

In this article, we’ll explain how a rent roll works, and how to determine the true value of an income-producing property before you sell, buy, or apply for financing.

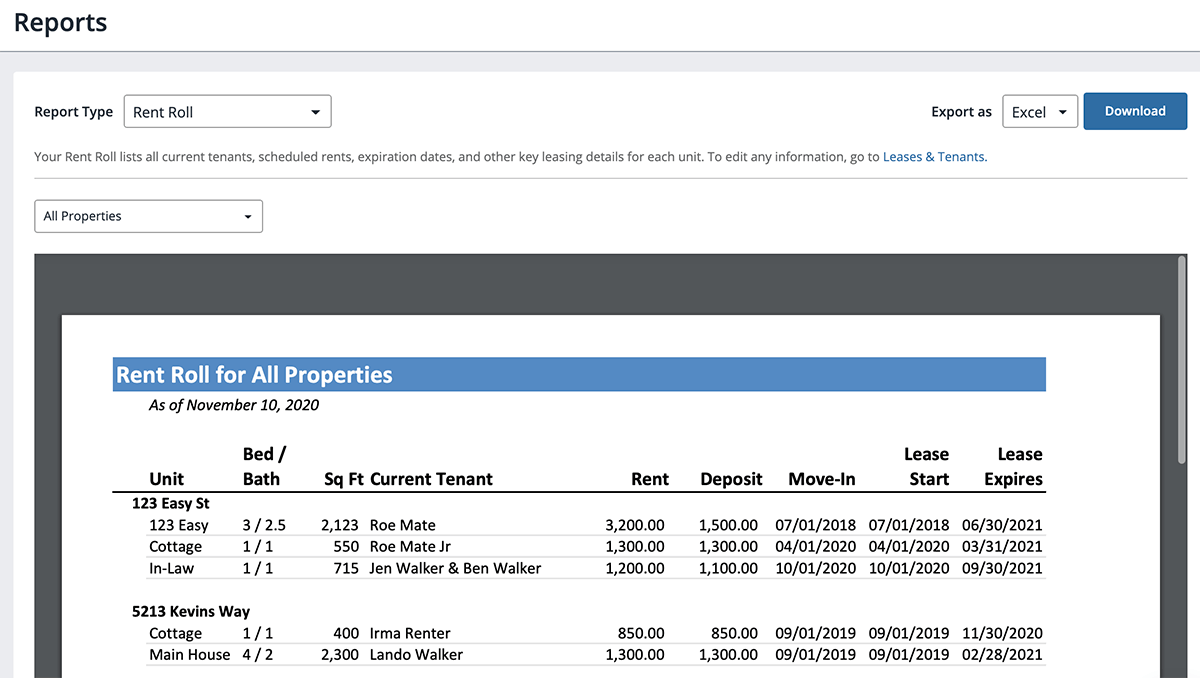

The rent roll provides an itemized report of each unit in an income-producing property. Information on a rent roll includes whether or not a unit is occupied, who the tenant is, the tenant’s payment history and security deposit being held, how long the tenant has occupied the property, and the expiration date of the current lease.

A rent roll is an important document that rental property investors, property managers, and lenders use to understand the income stream from a rental property. Rent rolls are created for any type of rental real estate asset, including houses and multifamily buildings, retail and office properties, and mixed-use developments.

You can create a rent roll at both a property and portfolio level, such as having a rent roll for a multifamily property or a consolidated rent roll if you own a group of single-family rental homes .

When you invest in rental real estate, what you are really buying is the income that the property generates. That’s why a real estate investor will oftentimes see more value in a turnkey rental property already generating income than in a vacant home in need of a tenant.

When correctly organized, a property’s rent roll will provide a real-time view of the gross cash flow the asset is generating. But just as importantly, a rent roll will help you understand whether the gross rental income is likely to stay the same, increase, or even decrease in the foreseeable future.

By comparing the rent roll to the income part of the profit and loss statement (P&L) rental property owners, potential buyers, and lenders can tell at a glance whether the gross income reported on the P&L is true and accurate.

If you are a buyer reviewing a property listed for sale, the rent roll shows you how much rental income should and is being collected. The rent roll report will also tell you how likely it is that the income being produced by the property will continue.

Will the cash flow continue?

For example, pretend you are buying a four-unit multifamily property (fourplex) in September and three of the four leases are scheduled to expire at the end of the year. You are almost guaranteed to have negative cash flow come January unless every lease can be renewed for at least the current rental rate.

In a situation like this, a prudent buyer would require the seller to renew the leases due to expire as a condition of closing so that the property continues to generate at least the current level of rental income after you close escrow.

Are the tenants seasoned?

The rent roll will also tell you how “seasoned” the tenants are. The word seasoned refers to how long a tenant has occupied the home, and by implication how likely they are likely to continue paying the rent.

As a rule of thumb, a tenant is seasoned after occupying a unit for a minimum of six months and paying the rent in full and on time. Using our fourplex as an example, you would place more value on the property if every tenant had been renting for two years compared to each unit being occupied for just two months.

Is the rent being paid as agreed?

By reviewing the rent roll you can also tell whether or not a tenant has been paying the rent as agreed to in the lease agreement.

Going back to our fourplex, the property may be fully occupied by the same tenants over the past two years. But if two of the four renters have been consistently paying late this year the odds are that at least one of the two tenants will “go bad” and will leave or need to be evicted sooner rather than later.

Can you increase cash flow?

Reviewing the rent roll before you buy the property can also reveal hidden opportunities to generate more monthly income.

For example, if the current rents are significantly below market and the lease ends soon, you may be able to raise the rents to market . If a current tenant can’t afford to pay the higher market rent, you can simply allow the lease to expire and find a new tenant who is willing to pay fair market rent.

Rental landlords and property managers can also use a rent roll in many of the same ways that a buyer does:

Lenders use a rent roll to understand the property’s past, current, and future potential income.

For example, if over the past few years a property has been generating consistent rental income and the tenants are seasoned, a mortgage broker or lender may see little risk in making a loan.

On the other hand, if the property has a history of high tenant turnover and an increasing vacancy rate, there may be an issue with the property management company, the tenant screening process, or with the rental property itself.

In many jurisdictions, landlords are required to collect a monthly rental or use tax from the tenant which is then paid to the local department of revenue. If the landlord is ever audited, the tax collector will review the rent roll to see if the property owner has been collecting and remitting the rental tax as required by local law.

A rent roll can be created for each individual property and also made for an entire rental property portfolio. The exact information on a rent roll varies by property type but always includes the following information:

Property Overview

House or Unit Data

Tenant Information

Rental Income Summary

Rental property owners can easily create a rent-roll using spreadsheet software such as Microsoft Excel, Google Sheets, or OpenOffice Calc:

You can download a sample rent roll template then make a copy and edit and customize it for your specific use.

TIP: If you’re a Stessa user, be sure to use your Rent Roll reports whenever you need to share leasing information with partners, lenders, or anyone else. And if you’re not a Stessa user yet, you can sign up for free here .

Even though the information on a good rent roll is extensive, the rent roll data comes from just a handful of sources:

A good rent roll gives property owners and managers, buyers and investors, and lenders and appraisers a real-time look at the total rent being collected from each tenant. Real estate investors can create a rent roll for each property, then roll up each individual report to create a rent roll at the portfolio level.

Rent rolls provide valuable information on the past, current, and future gross rental income of the property. The information on a rent roll is also used for financial metrics such as cap rate , ROI, and gross rent multiplier (GRM).